You need look no further than the hit TV show “Succession” to see how lack of a clear succession plan can tear a family — and business — asunder. Although the power struggles and drama are certainly heightened on the show, the dangers of failing to think ahead about leadership change are anything but fictional for construction businesses.

Don’t drag your feet

In a 2021 Construction Financial Management Association (CFMA) survey of construction executives, 50% of respondents reported they didn’t have an “ownership transfer plan.” That’s up from 39% in 2017. The figures aren’t surprising — humans are naturally reluctant to think about their later years or death. And construction company owners are usually busy with the day-to-day details of keeping their businesses profitable.

But the failure to think through succession can hurt a company’s value. This is particularly true when the owner is a larger-than-life character who’s popular with employees, customers, vendors, lenders and other stakeholders. Uncertainty about the future can lead to heated intrafamily disputes — or even ruptures — that can affect the many relationships that the owner has cultivated over the years.

Get the ball rolling

The first step is to define your succession-planning goals. Common examples include:

- Securing future financial stability for the owner, family members and the business,

- Keeping the company in the family,

- Treating children fairly whether they work for the business or not, and

- Giving valued employees an opportunity to step up and share in the company’s profits.

Owners who wish to be succeeded by a child or other family member should talk to the younger generation to gauge their interest and identify their skill sets. If anyone is pressured to take over, the construction company will likely suffer. Everyone must be on the same page about future roles, responsibilities and the corresponding financial rewards.

Weigh transfer options

Two-thirds of the respondents in the CFMA survey intend to sell their businesses to family members, employees or a combination of both. Family ownership transfers are often done through a gift or sale. The right choice depends on a variety of factors, including whether the owner needs retirement funds.

Gifting can make it easier to shift responsibilities for debts or other liabilities, while also reducing the owner’s taxable estate. Then again, owners who go the sale route have multiple options for structuring the deal. An installment plan, for example, could work as an annuity in retirement.

Note that a construction company’s purchase price probably will be less for family members than if the business were sold to a third-party buyer. But internal transfers can avoid some of the risks that come with outside owners, such as culture change. There’s also a better chance that the outgoing owner can retain some control through, for example, voting shares.

Stock redemptions are another alternative. Under these arrangements, the company buys some or all of the owner’s shares, increasing the ownership of the remaining shareholders.

For instance, if the owner has an 80% interest and his two children each have a 10% share, the owner can sell his interest, resulting in each child having a 50% interest. Redemptions must be carefully structured so the balance sheet isn’t weakened, and the company doesn’t fall out of compliance with any bonding or lending covenants.

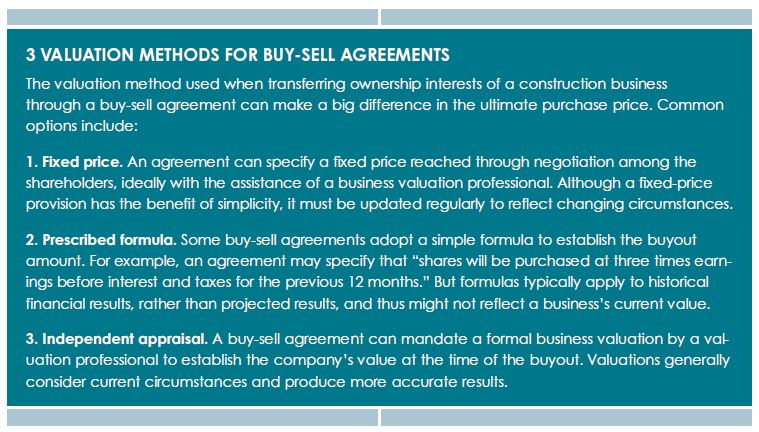

A stock redemption might be required under a buy-sell agreement. Such agreements often calculate the stock’s price according to an agreed-upon valuation method. (See “3 valuation methods for buy-sell agreements” above.)

Additional transfer options include recapitalization and employee stock ownership plans. Every option has pros and cons, including tax implications. Construction business owners should consider everything before choosing any approach.

Train your successor

Few designated successors are ready to drop into a company’s top position on a dime. Proper preparation is vital — and it’s not an overnight process.

A comprehensive training program will help reassure lenders and sureties that leadership will remain competent, knowledgeable and trustworthy. Construction business owners should evaluate intended successors for gaps in skills or other qualifications, so they can address them in advance.

The gaps might call for continuing education courses, on-the-job training, long-term mentoring and, finally, hands-on leadership experience. Responsibilities such as directing staff and interacting with lenders, customers and surety agents can then be gradually handed off.

Act now

It can take years to properly develop and implement a succession plan. Don’t wait until you’re on the cusp of retirement to get started. Your professional advisors, including your CPA and attorney, can help guide you through this typically complicated and emotional journey.

We welcome the opportunity to put our accounting expertise to work for you. To learn more about how our firm can help advance your success, don’t hesitate to contact Kathy Corcoran at (302) 254-8240.