Insights & Updates

Latest News and Expert Insights

Stop Breaches Now: Cybersecurity Culture, Not Just Tech

Cybersecurity has always ranked high on the list of business priorities, but the current shift to online services and remote work has heightened its importance. Fear of a breach or fraud is rightly top of mind for business leaders, especially

BOI Deadline Shift: Secure Your Small Business Now

The Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) is the agency that enforces the Corporate Transparency Act (CTA). Recently, FinCEN sent out a notice indicating a new deadline of March 21 for small businesses to comply with its beneficial ownership

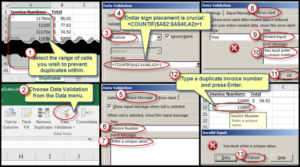

Excel Made Easy: Data Validation for Error Prevention

It’s often difficult to police a user’s actions within an Excel spreadsheet unless you’re aware of Data Validation. This feature is tucked away on Excel’s Data menu and allows you to create a variety of input rules. This article will

Nonprofit Audit Compliance: What You Need to Know

The Internal Revenue Service (IRS) doesn’t require nonprofits to have independent audits, but that doesn’t mean your nonprofit never needs an audit. Some federal, state, and local government agencies require audits, as do some banks and foundations. Generally, the requirements

Payroll Mistakes Cost You—Here’s How to Avoid Them

The endgame is accurate and timely employee paychecks. How do you get there? Have a payroll plan that outlines what the procedures are to get to your goal. The plan should describe how employees document and submit time. Use a

Business Tax Insights You Need to Know

If you’re running a business, you’re on the hook for a variety of taxes. Let’s take a look at the main categories: Income tax—All businesses except partnerships must file an annual income tax return. (Partnerships file an information return.) However,